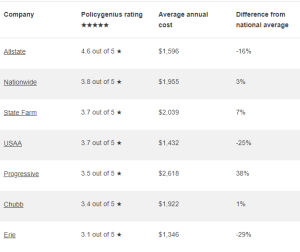

Compare rates for home insurance from reputable providers

There is no one size fits all homeowner’s insurance. You can find a policy that meets all of your needs, whether you’re seeking for the cheapest rate, the broadest selection of coverage options, first-class customer service, or all of the above, by comparing various house insurance quotes.

To assist you in making a more informed purchase decision, we evaluations take into account each company’s strengths and limitations in these areas and more. It also works! You will in secure the finest coverage for their needs while saving an average of 30% on homeowners insurance.

How to compare rates for house insurance

Comparing house insurance quotes entails more than just picking the provider with the lowest costs or the broadest scope of coverage. To ensure that you’re spending your money on a home insurance coverage that ticks all the right boxes, we break down particular elements you should consider when weighing your options.

Compare coverage limitations and any extra insurance you might require.

When you receive your bids, you should carefully review the policy limits, paying great attention to how your house, possessions, and personal responsibility are safeguarded.

Compare discounts, deductibles, and prices.

The price that is quoted to you may not be the price that you ultimately pay. Home insurance prices frequently ignore any reductions you could be eligible for. You may be able to reduce the cost of your house insurance by paying your premiums year up front, consolidating it with your auto insurance, or installing a new smart home security system.

This is why it’s important to evaluate not only the prices you’re given but also the various home insurance discounts provided by each insurer. For instance, it can be more cost-effective to go with a firm that has higher base rates but offers a sizable discount when you combine your house and auto policies.

The deductible you select also has a significant impact on the final cost of your home insurance. When you file a claim, you must pay this amount out of pocket before your insurance begins to pay the remaining balance. Your rates will be less expensive the bigger your deductible is, and vice versa.

Compare the claims handling procedures, customer satisfaction ratings, and financial standing of each business.

Last but not least, you should evaluate the financial stability and customer satisfaction ratings of each business. To put it another way: Verify that they have the resources to pay claims and are skilled at processing them.

They take into account information from J.D. Power, AM Best, and the National Association of Insurance Commissioners regarding financial strength, customer complaint scores, and claims satisfaction.

Customers actually place the greatest importance on claims satisfaction when evaluating insurance providers. Nearly 25% of homeowners, according to a recent national survey, place the greatest importance on an insurer’s claims satisfaction ratings, followed by the opportunity to combine house and auto insurance (22%) and strong customer review ratings (15%).